Archive for the ‘Divorce’ Category

Many people are under the misconception that they are required to “legally separate” before they can get divorced. In most jurisdictions, this is no longer required. If you want to get divorced, you should file for a divorce and not a legal separation. Filing for a legal separation first will only increase the time and expense before the divorce is final.

Many people are under the misconception that they are required to “legally separate” before they can get divorced. In most jurisdictions, this is no longer required. If you want to get divorced, you should file for a divorce and not a legal separation. Filing for a legal separation first will only increase the time and expense before the divorce is final.

However, we do run into several recurring situations that lend themselves to a filing of a separate support action (legal separation).

The first and most common situation is when the spouses have separated and one party needs to get support (child support and/or spousal support) from the other – but doesn’t want to file for divorce.

The second common reason is when a spouse has a drug and/or alcohol problem and the spouse filing for legal separation wants to send them a strong message “clean up your act or else”.

Although less common these days, devout Catholics will file for a legal separation because they don’t believe in divorce.

A legal separation should also be considered when the marriage is a little short of ten years. At the ten year mark, a spouse is entitled to one-half of the other spouse’s social security upon retirement (if they haven’t remarried and it’s more than they would be entitled to on their own social security claim).

There can also often be various strategic reasons to file for a legal separation instead of a divorce (such as if the other spouse has a new partner and will probably want to accelerate the divorce process).

Lastly, you should be aware that Courts will usually not divide property as part of a legal separation (although this doesn’t prevent the parties from agreeing to divide property between themselves) and that in most jurisdictions it is possible to counterclaim for divorce when one party files for separate support. Therefore, you might have effectively filed for divorce anyway!

Of course there are any number of things to consider prior to filing for divorce. Here are a few key items to reflect upon.

Of course there are any number of things to consider prior to filing for divorce. Here are a few key items to reflect upon.

1) The great majority–perhaps as high as 95%–of all divorce cases are settled before going to trial. Many cases are resolved through mediation or a joint petition for divorce in which both parties agree to all terms.

2) What are your most important long-term goals in the divorce? Before filing, create and understand your goals. This will help you to make better decisions and get where you want to go in the end.

3) Focus on what will be important in five years, not what seems hugely important now but may fade in a few years. Don’t get bogged down in details, money which won’t matter in a few years, or items like the stereo, computer or flatscreen TV.

4) Do you really want to represent yourself? You might think you’ll save big on attorney fees, but you’ll need to get all the relevant information and legal forms, and you may well miss important issues an experienced attorney will be quick to point out. At least consider hiring an attorney on an hourly basis to consult with on special issues.

5) Be Organized! Get your papers in order. Write down questions for your lawyer. Perhaps ask a trusted friend, relative, or your accountant to help you organize.

6) Look (and ask) before you leap: don’t jump to conclusions or rush to a decision. It takes time to build a reasonable, fair and equitable settlement. Because you will live with the results of your divorce for the rest of your life, take your time, talk to your support network, consult with your attorney, and do not rush into things.

After some time mulling over getting a divorce from your spouse, you have decided to take the plunge and call a family law or divorce attorney. Understandably, you may be nervous, anxious, excited, angry, frustrated, or any number of even conflicting emotions. After all, this is one of the biggest steps you can take in life. So what happens when you pick up that phone and call?

After some time mulling over getting a divorce from your spouse, you have decided to take the plunge and call a family law or divorce attorney. Understandably, you may be nervous, anxious, excited, angry, frustrated, or any number of even conflicting emotions. After all, this is one of the biggest steps you can take in life. So what happens when you pick up that phone and call?

Let’s assume you’ve done some investigation, looking into different law firms, maybe checking online reviews or getting referrals from friends and family. Then when you call, you should expect the office staff or attorney to be empathetic and someone who will comfortably ease your anxiety and relieve your initial stress in making the call. Beyond that initial receptivity, what should you expect?

First of all, you should expect confidentiality, and know that the law office will never disclose to your spouse or anyone else that you made the call. The confidential nature of your call is paramount.

You should expect the person on the other end of the line to ask a few basic questions, including your name, your spouse’s name, and perhaps your spouse’s attorney, if he or she has one. Other questions include asking where you live, how you heard about the office (website, ad, referral, etc.), and then on to the big question of the type of legal counsel you are seeking, such as initiating a divorce proceeding, modifying an existing agreement, or inquiries regarding child custody or support, alimony, and other matters. If you are seeking to initiate a divorce proceeding, the office may review fundamental options with you, briefly reviewing these options so you may best proceed. This may include a discussion of the differnet options of litigation (contesting the divorce in court), mediation (to resolve all matters), and collaborative process (each party agreeing to resolution outside of court).

Following this initial conversation, the lawyer or his/her staff will schedule your first in-person consultation at a time and place convenient for you.

The oft-cited statistic has it that 50% of US marriages end in divorce, rather than the death of a spouse (though the actual figure is between 40% and 50% depending upon statistical methodology applied). Does this make divorce a cause to celebrate, to rejoice in finally being free from the constraints of a failed marriage? Or rather a cause to lament, to decry the sorry state of our society? Of course, the truth is neither and both, with a wide range of grey inbetween.

The reality is extremely subjective, varying from person to person, and all parties involved, not merely the spouses. One spouse may rejoice, the other regret. And have you ever known children of a divorce throw a party, thrilled that their parents are finally separated (absent parental abuse, anyway)? No, of course divorce is a serious matter, a venture not lightly entered into, a life-changing course rivaled by few other events in one’s life. It is sage advice to consider all options before choosing divorce as the only recourse in a failed marriage. One’s marriage may not be failed after all, simply faltering, and steps may be taken to correct the course, through counseling and mediation among other measures.

But if divorce seems your only recourse, then it is imperative that you seek the legal advice of an experienced divorce attorney who can guide you through the maze of issues that arise with divorce proceedings, many if not most of which you may well not be aware of before commencing your divorce process. Consider how much of your life, public and private, financial and material, will be analyzed and debated in a court proceeding. In fact, this is largely why 90% of all divorces are settled out of court; spouses reach agreement without courtroom drama through the aid of legal advice and mediation and so can come to terms without court proceedings.

You often hear the statistic that 50% of all marriages end in divorce. Is this actually true? Mark Twain wrote in his autobiography that there are three kinds of lies: “Lies, damned lies, and statistics.” (While the quote is usually given as Twain’s, Twain himself attributed it to British Prime Minister Benjamin Disraeli.) Is this the case with the 50% “myth”? What is the present divorce rate in the USA?

Divorce rates have been rising all around the world, with the USA coming in sixth place for the highest divorce rate at 3.4 per 1000 population, trailing Russia (5), Belarus (3.8), Ukraine (3.6), Moldova (3.5 – interesting at all are former parts of the USSR), and Cayman Islands (3.4). Other major countries are not far behind, with Denmark at 2.7 per 1000, Switzerland 2.6, Spain 2.4, Australia 2.2, and Japan 2.0. But in all cases, the rate has been increasing in recent years and decades.

The actual percentage rate for America is between 40-50%, depending on how statistics are measured and which factors are considered contributing. And difference sources cite different (though relatively close) rates. For example, Jennifer Baker of Professional Psychology in Springfield, Missouri finds that 50% percent of first marriages, 67% of second marriages, and 74% of third marriages end in divorce, whereas the Enrichment Journal cites a 41% rate for first marriages, 60% for second, and 73% for third marriages. And it appears that couples with children have only a slightly lower rate of divorce than childless couples.

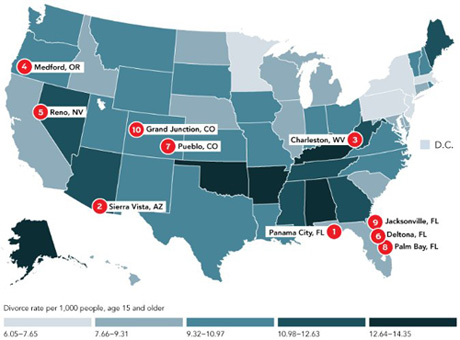

The Huffington Post (November 11, 2013) posted a map showing US divorce rate distribution by state, highlighting the “Divorce Capitals” of the US as shown below:

While the states with the highest divorce rates are Alabama, Alaska, Arkansas, Oklahoma, and Kentucy (all with rates betwee 12.64 and 14.35 per 1000), Massachusetts has one of the lowest rates, one of only five states with rates below 7.6 per 1000. Yet Masschusetts, by a long margin, was the first state to recognize same sex marriage (oft claimed by some as destructive of the family institution) and is often cited as one of the most liberal states in the country.

Another interesting divorce rate statistic is that divorce (and marriage) rates drop during economic recessions, in striking parallel, such that in 2000 the marriage rate was a little over 8 per 1000 and the divorce rate just about 8 per 1000, while both dipped to 3.5 or lower in 2008 and 2009, with the divorce rate since climbing slightly (by about .2 per 1000) and the marriage rate holding steady at about 3.4 per 1000.

As marriage equality continues to proceed in the USA, and especially here in Massachusetts, the first state to legalize same sex in the nation, many issues previously considered only as mother/father, heterosexual in nature now must be considered from the perspective of same sex couples. This came to light as regards the custody of a non-biological, same sex parent in the case of Della Corte v. Ramirez a little over two years ago. In this case, the biological mother, Gabriella Della Corte, argued that her ex-spouse had no parental or custodial rights because she was not the father of the child, who was born through artificial insemination. Angelica Ramirez, her spouse, argued that she indeed was the parent of the child and should be granted custody.

As marriage equality continues to proceed in the USA, and especially here in Massachusetts, the first state to legalize same sex in the nation, many issues previously considered only as mother/father, heterosexual in nature now must be considered from the perspective of same sex couples. This came to light as regards the custody of a non-biological, same sex parent in the case of Della Corte v. Ramirez a little over two years ago. In this case, the biological mother, Gabriella Della Corte, argued that her ex-spouse had no parental or custodial rights because she was not the father of the child, who was born through artificial insemination. Angelica Ramirez, her spouse, argued that she indeed was the parent of the child and should be granted custody.

The court found in favor of Ramirez, granting her joint custody of the child, stating in their ruling that Ramirez was the legal parent of the minor child. This sets a precedent in Massachusetts, establishing that as regards paternity, custody, and visitation, there is and should be no difference between heterosexual and same sex parents. This follows Massachusetts law that, regardless of gender, marriage carries the same rights for both parties. Therefore all laws which reference “husbands” or “wives” to be interpreted simply as “spouses,” and that Massachusetts family court proceedings should make no distinction based upon the gender of the parties, but rather paternity, custodial, and visitation rulings should solely reflect the best interests of the children involved.

Massachusetts Rules of Domestic Relations Procedure, Supplemental Rule 410, Mandatory Self Disclosure, details the documentation which must be disclosed within 45 days of service of the summons for a divorce proceeding, unless otherwise agreed by the parties thereto or ordered by the court.

Rule 410 details decrees that the following must be disclosed:

1) Both parties’ federal and state income tax returns and schedules for the past three (3) years, plus any non-public, limited partnership and privately held corporate returns for any entity in which either party has an interest. These must be disclosed together with all supporting documentation for tax returns, including but not limited to W-2’s, 1099’s, 1098’s, K-1, Schedule C and Schedule E.

2) All bank account statements for the past three (3) years, including those held in the name of either party, whether individually or jointly; those held in the name of another person for the benefit of either party; or those held by either party for the benefit of the parties’ minor children.

3) The four (4) most recent pay stubs from each employer for whom either party worked.

4) Documentation regarding the cost and nature of available health insurance coverage.

5) Statements for the past three (3) years for any securities, stocks, bonds, notes or obligations, certificates of deposit owned or held by either party or held by either party for the benefit of the parties’ minor children, 401K statements, IRA statements, and pension plan statement for all accounts listed on the 401 financial statement.

6) Copies of any loan or mortgage applications made, prepared or submitted by either party within the last three (3) years prior to the filing of the complaint for divorce.

7) Copies of any financial statement and/or statement of assets and liabilities prepared by either party within the last three (3) years prior to the filing of the complaint for divorce.

Additionally, during the progress of the case, both parties shall supplement all disclosures as material changes occur, such as increase or decrease in value of securities, bank accounts, or other financial instruments. Neither party shall be permitted to file any discovery motions prior to making the initial disclosure as described herein.

Unavailability of Documents: In the event that either party does not have any of the documents required by Rule 410 or has not been able to obtain them in a timely fashion, he or she shall state in writing, under the penalties of perjury, the specific documents which are not available, the reasons the documents are not available, and what efforts have been made to obtain the documents. As more information becomes available there is a continuing duty to supplement throughout the duration of the case.

In January 2011, following other states other states where alimony payment laws have changed as payors argue they are struggling in the current economy, Senator Gale Candaras, Esq. and Representative John Fernandes announced new legislation to reform the current Massachusetts alimony system. The Alimony Reform Act of 2011 as defined in the new law makes major changes to Massachusetts’ previous alimony legislation. So what are these changes and what implications do they have for alimony in Massachusetts? You can read a summary of Chapter 124 of the Acts of 2011, An Act Reforming Alimony in The Commonwealth here.

Among the most significant changes in the law is the implementation of a durational alimony scheme. Previously, when the court ordered a spouse to pay alimony pursuant to a divorce judgment, the payment period was indefinite and often referred to as “Alimony for Life.” However, under the Alimony Reform Act, the court now follows an Alimony Term Limits schema which determines the maximum length that alimony can be assigned depending upon circumstances.

- Long term marriages (more than 20 years): Alimony will end at retirement age as defined by the Social Security Act.

- 5 years or less: Maximum Alimony term is 50% of the number of months of marriage.

- 10 years or less but greater than 5 years: Maximum Alimony term is 60% of the number of months of marriage.

- 15 years or less but greater than 10 years: Maximum Alimony term is 70% of the number of months of marriage.

- 20 years or less but greater than 15 years: Maximum Alimony term is 80% of the number of months of marriage.

- Other term limits apply for “Rehabilitative Alimony, “Reimbursement Alimony”, and “Transitional Alimony”.

The Act also defines multiple types of alimony, which the court can utilize when creating a divorce order. Alongside the General Term Alimony following the schedule above, the law establishes three other term limits which apply to Rehabilitative Alimony, Reimbursement Alimony, and Transitional Alimony. These types of alimony can be ordered in place of the General Term Alimony for a duration of less than five years. Under the reform, a judge has discretion to order one of the shorter types of alimony, even when the General Term Alimony would dictate a longer period of alimony.

Grounds for Termination of Alimony

Under the Act, General Term Alimony can terminate when the recipient remarries or cohabitates with a new partner. Under the previous terms of the law, cohabitation was inadequate reason to terminate alimony, and there were some cases where alimony did not terminate upon remarriage of the recipient. The new law can thereby affect alimony recipients who cohabitate with a boyfriend or girlfriend in order to avoid marriage and thereby continue to receive alimony payments from their ex-spouses.

The Alimony Reform Act also states that General Term Alimony shall terminate upon the payor reaching the full retirement age or when that person becomes eligible for the old-age retirement benefit under the United States Old-Age, Disability, and Survivors Insurance Act. As you can imagine, this has significant implications for people who divorce when approaching retirement age, as previously retirement was not in itself sufficient to warrant termination of an alimony obligation. As judges are taking the position that there is a rebuttable presumption that alimony shall be terminated under such circumstances, you should consult with an experienced divorce attorney.

Determining the Amount of Alimony to Be Paid

Under the Alimony Reform Act, the court excludes a number of income sources from its determination of an alimony award, such as the gross income used to determine a spouse’s child support obligation.

Additionally, the Act further excludes any income the payor spouse receives from a second job or overtime from a determination of alimony. A somewhat fuzzy area regards a spouse who is not paid an hourly wage, but instead receives a weekly salary regardless of how many hours per week he or she works.

Another consideration under the Alimony Reform Act address circumstances where a payor spouse remarries. Under the new law, the new spouse’s income is no longer considered for the purpose of increasing the payor spouse’s alimony obligation. Obviously, this has strong implications for cases in which a payor spouse remarries someone with financial strength while the recipient ex-spouse has encountered financial difficulties.

Modifications of Alimony Orders Prior to the Alimony Reform Act

The overview: the Alimony Reform Act is a sufficient material change in circumstance to alter the duration of a previously ordered alimony award, but it does not justify a change in the amount of alimony that was previously awarded. In cases where the parties to a divorce agreement stating that their alimony order shall not be modifiable will not be entitled to modify their alimony order based on the Alimony Reform Act. So while the act has some impact on pre-act alimony orders, these impacts are limited.

What does this really mean for anyone with a pre-act alimony order? If you were ordered to pay alimony prior to the enactment of the new law, you can only seek modification for the duration of your obligation and can not obtain a modification for the actual amount of alimony that you were originally ordered to pay.

While these modification changes may sound appealing if you are paying alimony from a prior alimony oder, you should review the circumstances and potential ramifications of seeking a modification with a qualified divorce attorney as you may find yourself involved in a counter claim for an increase by the alimony recipient. Indeed, given the range of changes to the law under the Alimony Reform Act of 2011, it remains vital that you consult with an experience divorce attorney to analyze your circumstances and determine your optimal action.

This past June, in a landmark decision, the US Supreme Court found the Defense of Marriage Act (DOMA) unconstitutional, declaring that that same-sex couples who are legally married in a state recognizing same sex marriage deserve equal rights to the benefits under federal law that go to all other married couples. This decision is widely seen as striking down DOMA in favor of marriage equality, but of course it’s more complex than that and the ramifications are now unfolding.

The latest major change as a result of the DOMA decision is that the IRS now will recognize same sex married partners as married regardless of the state in which they reside, thereby requiring that such couples file their federal income tax returns as either married filing jointly or married filing separately; they can no longer file separately as unmarried individuals (same as for heterosexual married couples). The IRS is also allowing such couples to file amended income tax returns for prior years in which they may have paid too much as a result of filing separately, but they do not have to file amended returns if doing so would result in higher taxes than they paid. This is indeed welcomed news for all such parties.

One wrinkle however is that such couples, if residing in a state which does not recognize same sex marriage after having been legally married in a state which does, may be required to file state income tax returns separately, a complication augmented by the fact that state income tax filing generally follows from federal. Still, overall this is a progressive move.

Another complication is that, while this key component of DOMA was overturned, another major component remains: Section 2 of DOMA declares that those states which do not recognized marriage equality (same sex marriage) do not have to recognize any same sex marriage from states which such marriage are legal. This not only informs the tax code as referenced above, but also can complicate divorce proceedings for same sex couple residing in a state which does not recognize same sex marriage. How so? If a couple is not recognized as legally married in a given state, then that state can deny that couple the right to divorce since, according to state law, they are not married to begin with. Furthermore, they cannot return to the state where they were married for the purpose of seeking a divorce since all states require residency for such proceedings. This would mean that such a couple would have to uproot themselves from their current state of residence and re-establish residency in the state in which they were married prior to seeking divorce.

On Monday, September 26, 2011, Governor Deval Patrick signed into law Chapter 124 of the Acts of 2011, An Act Reforming Alimony in The Commonwealth. This law sets new limits on alimony in Massachusetts, sharply curbing lifetime alimony payments in divorce cases and making a series of other changes to a system that critics considered outdated. Below is a summary of the law. See my blog post of May, 2012 for a discussion of the implications of the new law.

- Alimony Term Limits

- Long term marriages (more than 20 years): Alimony will end at retirement age as defined by the Social Security Act.

- 5 years or less: Maximum Alimony term is 50% of the number of months of marriage.

- 10 years or less but greater than 5 years: Maximum Alimony term is 60% of the number of months of marriage.

- 15 years or less but greater than 10 years: Maximum Alimony term is 70% of the number of months of marriage.

- 20 years or less but greater than 15 years: Maximum Alimony term is 80% of the number of months of marriage.

- Other term limits apply for "Rehabilitative Alimony, "Reimbursement Alimony", and "Transitional Alimony".

- Second Wife’s (Husband’s) Income and Assets Excluded

"In the event of the payer’s remarriage, income and assets of the payer’s spouse shall not be considered in a re-determination of alimony in a modification action." - Co-Habitation Suspends, Reduces, or Terminates Alimony

"General Term Alimony shall be suspended, reduced or terminated upon the cohabitation of the recipient spouse when the payer shows that the recipient has maintained a common household with another person for a continuous period of at least three months." - Child Support: Gross Income is Excluded From Alimony

For purposes of setting an alimony order, the court shall exclude from its income calculation gross income which the court has already considered for setting a child support order…" - Child Support: Alimony Term is Co-Terminus with Child Support

"Where the Court orders alimony concurrent with or subsequent to a child support order, the combined duration of alimony and child support shall not exceed the longer of: (i) the alimony duration available at the time of divorce; or (ii) rehabilitative alimony commencing upon the termination of child support. " - Alimony Amount is Limited

"… the amount of alimony should generally not exceed the recipient’s need or 30 percent to 35 percent of the difference between the parties gross incomes established at the time of the order being issued." - A Second Job or Overtime Income is Not Included in Alimony Modification

"Income from a second job or overtime work shall be presumed immaterial to alimony modification if:

(1) A party works more than a single full-time equivalent position; and

(2) The second job or overtime commenced after entry of the initial order." - Payment of Health Insurance and/or Life Insurance Reduces Alimony Payment

In setting an initial alimony order, or in modifying an existing order, the court may deviate from duration and amount limits for General Term Alimony and Rehabilitative Alimony upon written findings that deviation is necessary. Grounds for deviation may include:

(3) Whether the payer spouse is providing health insurance and the cost of health insurance for the recipient spouse;

(4) Whether the payer spouse has been ordered to secure life insurance for the benefit of the recipient spouse and the cost of such insurance; - Alimony Term Extensions Are Limited And Require Clear And Convincing Evidence

"The court may grant a recipient an extension of an existing alimony order for good cause shown. In granting extension, the court must enter written findings of:

(i) A material change of circumstance that occurred after entry of the alimony judgment; and (ii) Reasons for the extension that are supported by clear and convincing evidence. - Alimony Ends with the Remarriage of the Alimony Recipient

We all know the expression, nothing is inevitable but death and taxes. Federal and state income taxes are not only inevitable, but complicated by a divorce proceeding. If you and your spouse are in the process of getting divorced, the question arises, how should you file your taxes? According to the IRS, so long as you are married, you must file as married. The choice is whether to file jointly or separately. One spouse cannot force the other to file jointly.

But the situation is trickier once the divorce has been granted. Assume that you were divorced in December. Can you then file jointly for the year, during most of which you were married? No, you must file an individual return for the entire year. The IRS is clear on this, stating in Publication 504 that one is considered to be single or unmarried for the entire year even if divorce was granted on December 31. What are the implications of this rule? When a married couple files a joint return, both spouses are held jointly and individually liable for all interest and/or penalties due on that joint return. It does not matter who earned the income; a spouse who did not earn any income may still be held liable for all due taxes on the other spouse’s earned income. Your Separation Agreement may even specify that your former spouse will be liable for any taxes or penalties due on your joint return, but the IRS under Publication 504 may still hold both parties jointly and individually liable for any amount owed.

What about claiming your child(ren) as dependent(s) on your return after the divorce becomes effective? Only one parent may claim dependency of a child, and there are any number of factors which play into this determination. Child dependency is normally declared in the Separation Agreement. If you and your spouse have more than one child, they may be divided between the households. Your Separation Agreement may specify alternating years as the custodial parent, so that one year you may claim your child, and the next year your ex can claim that child. According to the IRS definition, the custodial parent is the parent with whom the child lived with for a longer period of time during the year, counted by number of nights spent in that parent’s care. What if a child lived an equal length of time with both parents? In such a case, the IRS guidelines state that the parent with the higher adjusted gross income can claim the child as an exemption.

There are many other factors, including the language of the Separation Agreement, as for instance if the Separation Agreement declares that the “noncustodial” parent is supposed to claim the child on his or her tax return? In order to satisfy such an arrangement, the child dependency exemption has to be transferred from the “custodial” parent to the “noncustodial” parent, requiring that several conditions be met for the IRS to accept the change. Obviously, such details need to be worked out in advance with the advice and guidance of an experienced divorce attorney.