Posts Tagged ‘Divorce Planning’

The NY Times, along with several other news sources, recently published an article examining, once again, the “50% Myth” of divorce rates in the USA. I commented on this back in June of 2014 (see US Divorce Rate: The 50% Myth). This is of course a very complex issue with multiple levels of interpretation and analysis from an array of viewpoints both statistical and sociological. However, three main trends are evident:

The NY Times, along with several other news sources, recently published an article examining, once again, the “50% Myth” of divorce rates in the USA. I commented on this back in June of 2014 (see US Divorce Rate: The 50% Myth). This is of course a very complex issue with multiple levels of interpretation and analysis from an array of viewpoints both statistical and sociological. However, three main trends are evident:

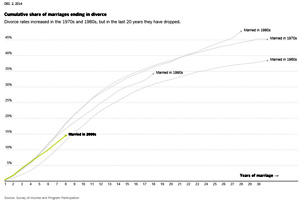

1) Divorce rates surged in the 1970s and 1980s, but since have dropped significantly, first in the 1990s and even more so in the 2000s.

2) Couples are marrying later in life: The median age for marriage in 1890 was 26 for men and 22 for women. By the 1950s, it had dropped to 23 for men and 20 for women. In 2004, it climbed to 27 for men and 26 for women.

3) Fewer couples are getting married per capita: many younger couples are living together prior to or instead of marrying, which reduces the divorce rate for couples in their early twenties.

Of course, this is also a simplified view. Much statistical analysis can be applied to these data. For example, one recurring source of the 50% “rule” is that approximately 2.4 million couples marry in a given year, and 1.2 million divorce. 50%, right? But these divorces are not drawn from the same set as the marriages, or, put another way, half of those married in any given year do not divorce in that same year. More significantly, the number of divorces and marriages are taken as totals from the general population, and not from more definitive samples: the percentage of divorces among second (60-67%) and third (70-73%) marriages is much higher than among marriages that don’t end in divorce, skewing the numbers.

A more accurate approach would be to calculate how many people who ever married subsequently divorced. Calculated in this manner, the US divorce rate has never exceeded 41 percent, and in fact is currently dropping. According to the 2001 survey of the Fertility and Family Branch of the Census Bureau, the rate of divorce for men between 50 and 59 was 41% and for women between 50 and 59 was 39%.

In any case, divorce is a real consideration in marriage, ultimately affecting close to 4 in 10 couples. If you find yourself in the 40 percentile, consider consulting a qualified divorce attorney to examine your situation and the best way forward.

There is no “one size fits all” answer as to whether you should be the first to file for divorce. There are various reasons why it may or may not be to your strategic advantage to be the first to file. You might even think of it in sports terminology: Do I play offense or defense?

There is no “one size fits all” answer as to whether you should be the first to file for divorce. There are various reasons why it may or may not be to your strategic advantage to be the first to file. You might even think of it in sports terminology: Do I play offense or defense?

Some of the reasons that you may want to file first include:

1) A likely decision by the Court that is favorable to what you are seeking;

2) A need to finalize the divorce as soon as possible to allow for remarriage;

3) A psychological need to end the marriage as soon as possible in order to move on with your life;

4) A need to send a clear and unequivocal message to your spouse that “the marriage is over and that there is no hope for reconciliation”;

5) A need to force your spouse to vacate the marital domicile;

6) A need to put into place orders to protect marital assets;

7) A need to obtain orders for alimony or child support;

8) A need to obtain an order for child custody or to ask that you be allowed to remove the children from the current state of residence;

9) A need to expedite the sale of a marital home or other marital property.

Conversely, some of the reasons that you may not want to be the first to file for divorce include the following:

1) A likely decision by the Court that would not be favorable to you (and the possibility that you might be able to arrive at an agreement with your spouse that would be signifcantly better for you than what the Court would order in your circumstances);

2) Situations where the current support being provided by your spouse is more than you could reasonably expect the Court to order;

3) When your spouse is gravely ill and you want to preserve an interest in their portion of the marital estate;

4) Situations where your spouse is in a “hurry” to finalize a divorce (either for psychological reasons or for a desire to remarry) and you gain a tactical advantage in negotiating an agreement from their haste to resolve the matter as quickly as possible;

5) When you believe the marriage is still salvageable.

With the exception of the analysis of your particular situation and likely outcomes by the Court, most of the above is fairly straightforward. An experienced divorce attorney that understands the tendencies of the Courts and judges in your particular jurisdiction should be able to study your particular situation, perform this analysis and advise you as to your best course of action.

Of course there are any number of things to consider prior to filing for divorce. Here are a few key items to reflect upon.

Of course there are any number of things to consider prior to filing for divorce. Here are a few key items to reflect upon.

1) The great majority–perhaps as high as 95%–of all divorce cases are settled before going to trial. Many cases are resolved through mediation or a joint petition for divorce in which both parties agree to all terms.

2) What are your most important long-term goals in the divorce? Before filing, create and understand your goals. This will help you to make better decisions and get where you want to go in the end.

3) Focus on what will be important in five years, not what seems hugely important now but may fade in a few years. Don’t get bogged down in details, money which won’t matter in a few years, or items like the stereo, computer or flatscreen TV.

4) Do you really want to represent yourself? You might think you’ll save big on attorney fees, but you’ll need to get all the relevant information and legal forms, and you may well miss important issues an experienced attorney will be quick to point out. At least consider hiring an attorney on an hourly basis to consult with on special issues.

5) Be Organized! Get your papers in order. Write down questions for your lawyer. Perhaps ask a trusted friend, relative, or your accountant to help you organize.

6) Look (and ask) before you leap: don’t jump to conclusions or rush to a decision. It takes time to build a reasonable, fair and equitable settlement. Because you will live with the results of your divorce for the rest of your life, take your time, talk to your support network, consult with your attorney, and do not rush into things.

After some time mulling over getting a divorce from your spouse, you have decided to take the plunge and call a family law or divorce attorney. Understandably, you may be nervous, anxious, excited, angry, frustrated, or any number of even conflicting emotions. After all, this is one of the biggest steps you can take in life. So what happens when you pick up that phone and call?

After some time mulling over getting a divorce from your spouse, you have decided to take the plunge and call a family law or divorce attorney. Understandably, you may be nervous, anxious, excited, angry, frustrated, or any number of even conflicting emotions. After all, this is one of the biggest steps you can take in life. So what happens when you pick up that phone and call?

Let’s assume you’ve done some investigation, looking into different law firms, maybe checking online reviews or getting referrals from friends and family. Then when you call, you should expect the office staff or attorney to be empathetic and someone who will comfortably ease your anxiety and relieve your initial stress in making the call. Beyond that initial receptivity, what should you expect?

First of all, you should expect confidentiality, and know that the law office will never disclose to your spouse or anyone else that you made the call. The confidential nature of your call is paramount.

You should expect the person on the other end of the line to ask a few basic questions, including your name, your spouse’s name, and perhaps your spouse’s attorney, if he or she has one. Other questions include asking where you live, how you heard about the office (website, ad, referral, etc.), and then on to the big question of the type of legal counsel you are seeking, such as initiating a divorce proceeding, modifying an existing agreement, or inquiries regarding child custody or support, alimony, and other matters. If you are seeking to initiate a divorce proceeding, the office may review fundamental options with you, briefly reviewing these options so you may best proceed. This may include a discussion of the differnet options of litigation (contesting the divorce in court), mediation (to resolve all matters), and collaborative process (each party agreeing to resolution outside of court).

Following this initial conversation, the lawyer or his/her staff will schedule your first in-person consultation at a time and place convenient for you.

Massachusetts Rules of Domestic Relations Procedure, Supplemental Rule 410, Mandatory Self Disclosure, details the documentation which must be disclosed within 45 days of service of the summons for a divorce proceeding, unless otherwise agreed by the parties thereto or ordered by the court.

Rule 410 details decrees that the following must be disclosed:

1) Both parties’ federal and state income tax returns and schedules for the past three (3) years, plus any non-public, limited partnership and privately held corporate returns for any entity in which either party has an interest. These must be disclosed together with all supporting documentation for tax returns, including but not limited to W-2’s, 1099’s, 1098’s, K-1, Schedule C and Schedule E.

2) All bank account statements for the past three (3) years, including those held in the name of either party, whether individually or jointly; those held in the name of another person for the benefit of either party; or those held by either party for the benefit of the parties’ minor children.

3) The four (4) most recent pay stubs from each employer for whom either party worked.

4) Documentation regarding the cost and nature of available health insurance coverage.

5) Statements for the past three (3) years for any securities, stocks, bonds, notes or obligations, certificates of deposit owned or held by either party or held by either party for the benefit of the parties’ minor children, 401K statements, IRA statements, and pension plan statement for all accounts listed on the 401 financial statement.

6) Copies of any loan or mortgage applications made, prepared or submitted by either party within the last three (3) years prior to the filing of the complaint for divorce.

7) Copies of any financial statement and/or statement of assets and liabilities prepared by either party within the last three (3) years prior to the filing of the complaint for divorce.

Additionally, during the progress of the case, both parties shall supplement all disclosures as material changes occur, such as increase or decrease in value of securities, bank accounts, or other financial instruments. Neither party shall be permitted to file any discovery motions prior to making the initial disclosure as described herein.

Unavailability of Documents: In the event that either party does not have any of the documents required by Rule 410 or has not been able to obtain them in a timely fashion, he or she shall state in writing, under the penalties of perjury, the specific documents which are not available, the reasons the documents are not available, and what efforts have been made to obtain the documents. As more information becomes available there is a continuing duty to supplement throughout the duration of the case.

This past June, in a landmark decision, the US Supreme Court found the Defense of Marriage Act (DOMA) unconstitutional, declaring that that same-sex couples who are legally married in a state recognizing same sex marriage deserve equal rights to the benefits under federal law that go to all other married couples. This decision is widely seen as striking down DOMA in favor of marriage equality, but of course it’s more complex than that and the ramifications are now unfolding.

The latest major change as a result of the DOMA decision is that the IRS now will recognize same sex married partners as married regardless of the state in which they reside, thereby requiring that such couples file their federal income tax returns as either married filing jointly or married filing separately; they can no longer file separately as unmarried individuals (same as for heterosexual married couples). The IRS is also allowing such couples to file amended income tax returns for prior years in which they may have paid too much as a result of filing separately, but they do not have to file amended returns if doing so would result in higher taxes than they paid. This is indeed welcomed news for all such parties.

One wrinkle however is that such couples, if residing in a state which does not recognize same sex marriage after having been legally married in a state which does, may be required to file state income tax returns separately, a complication augmented by the fact that state income tax filing generally follows from federal. Still, overall this is a progressive move.

Another complication is that, while this key component of DOMA was overturned, another major component remains: Section 2 of DOMA declares that those states which do not recognized marriage equality (same sex marriage) do not have to recognize any same sex marriage from states which such marriage are legal. This not only informs the tax code as referenced above, but also can complicate divorce proceedings for same sex couple residing in a state which does not recognize same sex marriage. How so? If a couple is not recognized as legally married in a given state, then that state can deny that couple the right to divorce since, according to state law, they are not married to begin with. Furthermore, they cannot return to the state where they were married for the purpose of seeking a divorce since all states require residency for such proceedings. This would mean that such a couple would have to uproot themselves from their current state of residence and re-establish residency in the state in which they were married prior to seeking divorce.

We all know the expression, nothing is inevitable but death and taxes. Federal and state income taxes are not only inevitable, but complicated by a divorce proceeding. If you and your spouse are in the process of getting divorced, the question arises, how should you file your taxes? According to the IRS, so long as you are married, you must file as married. The choice is whether to file jointly or separately. One spouse cannot force the other to file jointly.

But the situation is trickier once the divorce has been granted. Assume that you were divorced in December. Can you then file jointly for the year, during most of which you were married? No, you must file an individual return for the entire year. The IRS is clear on this, stating in Publication 504 that one is considered to be single or unmarried for the entire year even if divorce was granted on December 31. What are the implications of this rule? When a married couple files a joint return, both spouses are held jointly and individually liable for all interest and/or penalties due on that joint return. It does not matter who earned the income; a spouse who did not earn any income may still be held liable for all due taxes on the other spouse’s earned income. Your Separation Agreement may even specify that your former spouse will be liable for any taxes or penalties due on your joint return, but the IRS under Publication 504 may still hold both parties jointly and individually liable for any amount owed.

What about claiming your child(ren) as dependent(s) on your return after the divorce becomes effective? Only one parent may claim dependency of a child, and there are any number of factors which play into this determination. Child dependency is normally declared in the Separation Agreement. If you and your spouse have more than one child, they may be divided between the households. Your Separation Agreement may specify alternating years as the custodial parent, so that one year you may claim your child, and the next year your ex can claim that child. According to the IRS definition, the custodial parent is the parent with whom the child lived with for a longer period of time during the year, counted by number of nights spent in that parent’s care. What if a child lived an equal length of time with both parents? In such a case, the IRS guidelines state that the parent with the higher adjusted gross income can claim the child as an exemption.

There are many other factors, including the language of the Separation Agreement, as for instance if the Separation Agreement declares that the “noncustodial” parent is supposed to claim the child on his or her tax return? In order to satisfy such an arrangement, the child dependency exemption has to be transferred from the “custodial” parent to the “noncustodial” parent, requiring that several conditions be met for the IRS to accept the change. Obviously, such details need to be worked out in advance with the advice and guidance of an experienced divorce attorney.

Everyone knows that divorce is extremely stressful, even in the most amicable of circumstances. In fact, the landmark study by Holmes and Rahe in 1967, which resulted in the now famous original list of 43 life-events called the Social Readjustment Rating Scale (SRRS), lists divorce as the number two most stressful life event after death of a spouse, and marital separation as number three; the top five are listed below:

Life-Event …. Stress Rating

1. Death of spouse …. 100

2. Divorce …. 73

3. Marital separation …. 65

4. Jail term …. 63

5. Death of close family member …. 63

Perhaps this is a bit misleading, in that not getting a divorce when spouses no longer belong together can, over the long haul, be cumulatively more stressful: that is, the divorce itself is stressful for a short time (the divorce proceeding itself and a period of adjustment afterwards), but not getting that divorce when you believe you should can stretch that stress over years or even decades.

So, you’ve decided that divorce is right for your situation. The next step is the most important: choosing a drivorce lawyer to represent you. What do you look for in a divorce attorney? The answers (or qualifications) are many and varied, but here are a few key items to bear in mind.

You need to locate an attorney who is experienced in Family Law, with significant trial experience. You want a lawyer who can speak with you in plain English, not mumbo-jumbo legalese. And you want an attorney you feel comfortable with and can trust, since you will be revealing very personal and private information about yourself, your marriage, your family and your life.

Point-by-Point: Questions to Ask about a Prospective Lawyer:

- Does he or she make you feel comfortable?

- Does he or she have extensive courtroom experience in Family Law?

- Is the lawyer a specialist or a generalist?

- Is there a potential conflict of interest because this lawyer has worked with both you and your spouse in the past (even on apparently unrelated matters)?

- Has he or she discussed confidentiality with you?

- Does he or she talk about other clients in front of you?

These are a few basic considerations to bear in mind.

Be prepared for your first meeting with your divorce attorney by planning ahead. A major step in this direction is to gather all of your Essential Papers in an Essential Papers File in a safe place. You will then bring this file with you to your initial meeting with your attorney, so that these items are ready for review at the start of the process.

What are Essential Papers? Documents such as copies of your tax returns for the past three years; the deed to your home and any other real estate, plus any items that may affect the cost basis of your home, including receipts for major repairs or renovations; your birth certificate; your marriage certificate; your passport; automobile title(s); insurance forms; bank account statements; outstanding debts; and stock certificates and other investment documents.

Also include a listing of names, addresses and contact info for key people or businesses such as your attorney, accountant, stockbroker, financial planner, creditors, and executor of your will and estate.

You may also want to consider recording a video of your home and its contents to document the value and appearance of the house and valuables. Keep this tape or digital recording with a list of valuables, including description, when and where acquired, original cost and current value (if a collectible), and where possible the serial number of the item (included with all electronics but not necessarily with other items), in a safe place, preferrably not in the marital home.

Armed with these items, your attorney will be better able to advise you from your very first meeting. However, if you think that divorce may be imminent, it is important that you get the advice of an experienced divorce attorney as soon as possible. Don’t delay doing this because you are gathering documents and information. Your divorce attorney will advise you on how to best proceed.

Many couples find themselves in the situation where they desire to separate but do not want to divorce due to religious objections, where a spouse suffers from a substance abuse or other serious personal problem, or a spouse wants to preserve inheritance rights. Many think of legal separation as an alternative. The concept of legal separation is to establish a trial period during which spouses live apart in accord with rights established by the court to while deciding about reconciliation or divorce. However, in Massachusetts, there is no statute providing couples with this option of legal separation as such. Instead, if you wish to separate and have protections under the law, you will need to file for divorce or separate support with the court and live separately based upon the provisions listed in the court’s temporary order. An agreement for a trial separation without filing for divorce must be made outside of court.

In Massachusetts, separate support allows a form of legal separation, most often used by people with a deep religious objection to divorce who feel they can no longer live with their spouse. There are other common situations where separate support may be appropriate when a spouse does not wish to divorce:

When a spouse wants to preserve inheritance rights (particularly older people who will not remarry);

When a spouse hopes to reconcile with a spouse who is undergoing personal difficulties (such as a substance abuse problem); and

When a spouse does not want to divide property for various reasons (such as maintaining an intact business interest).

The principal purpose of an action for separate support is to compel a spouse to furnish support for his or her abandoned spouse and minor children during the term of the marriage and the time that the cause for separation exists. The court that adjudicates an action for separate support cannot dissolve the marriage nor provide for a division of properties. Although the process in many ways looks like a divorce and incurs the same time and expense as a divorce, in the end the spouses remain married. If the decision is then reached to divorce, then you start the process again by filing a new action for divorce.

However, by providing a method for a spouse to obtain a judgment determining his or her status as an abandoned husband or wife, separate support can secure that spouse freedom from interference with his or her personal liberty by the other spouse. It also provides a method to determine who is granted custody of the children.

Many people believe that it is necessary to file an action for separate support prior to filing for divorce. This is incorrect. The courts liberally apply the term “living separate and apart.” Therefore, it is possible to pursue this action in cases of nonsupport while the parties still reside under the same roof.

Lastly, it should be noted that even though a plaintiff files an action for separate support, the defendant may counterclaim for divorce. Under these circumstances, it is extremely likely that a divorce will be granted (particularly if the counterclaim asserts the grounds of irretrievable breakdown) when the case is finally adjudicated. Thus, the separate support action would become moot.

Joe and Cindy have been married for 12 years. They have two kids, ages 6 and 10, and bought a 3-bedroom ranch in a western suburb of Boston seven years ago. They have since remodeled, adding a porch, a car port, and expanding and redesigning the kitchen. However, they started having marital problems two years ago, as Joe spent more and more time at work and Cindy began donating ever more time for various causes, until both began feeling abandoned by the other. So Joe moved out of the house 10 months ago, months before they decided to seek a divorce, and now he finds himself angry at having to support his new home as well as the home he left, and feeling cut off at the same time.

Often the first spouse – in this case, Joe – to move out of the marital home is at a disadvantage. The spouse that remains in the home – such as Cindy – may have leverage as to obtaining more support to pay for the mortgage and support. The situation may worsen for the spouse who moved out in a case where the spouse who remained in the home seeks to buyout the first spouse, as that party will often delay to gain more leverage in negotiating a better deal. Often the process will drag on and the spouse who has vacated will settle for less to be able to move from their “temporary situation.” Other times, a better deal can be negotiated with a spouse who is unhappy (dare I say miserable!) to be still residing with their soon-to-be ex. However, the potential for a restraining order can also be a danger for a spouse who chooses to remain in the marital home during the pendency of a divorce. Bottom line – don’t make hasty decisions; your best bet is to discuss your particular case with an experienced divorce attorney that can advise you of the pros and cons of vacating a marital home.